US Debt – Attacks On ‘Entitlements’

If you wondered why everyone keeps talking about Social Security and Medicare as if they have something to do with the National Debt, when they have been running surpluses for years and have a large trust fund – well this is the answer.

The trust fund is invested in Treasury bills, and when the revenues from the separate tax that pays for the program, no longer covers the costs of the program, those T-bills will be redeemed. By law, the system cannot run a deficit. The politicians don’t want to pay back all of the money they borrowed from the trust fund to hide the real size of the deficits they have been running.

The entire surplus that the Shrubbery gave away in tax cuts to the wealthy was from the Social Security trust fund, not from income taxes.

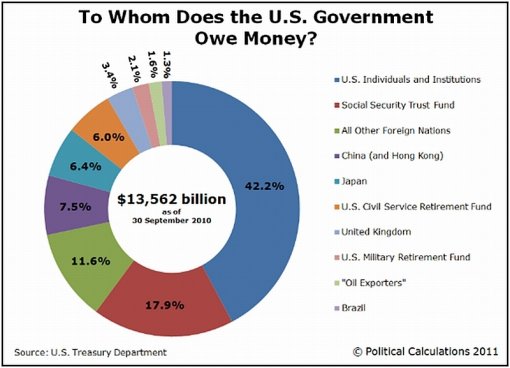

Just over a quarter [26%] of the debt is owed to the Social Security Trust Fund, and the retirement systems of the Civil Service and military, but all people want to talk about is the 7.5% that China holds.

17 comments

This is a very good series you’ve posted here Bryan. 🙂

I’ve been catching up on ‘The Daily Show’ (that I missed the past few months), and Jon thinks as you do (though in his own style, of course). 🙂

Hopefully, the mindless masses will wake up when it’s simplified for them. Ahh, well… “Hope” does indeed spring eternal (and I notice Obama has carefully left out the *H* word out of his diatribes lately). 😉 Funny that…

It is rather obvious, Kryten, if you look at the facts and have lived through it from the beginning under Reagan

Mr. Duff, see the How chart, except that “Entitlements” do not belong on the chart because “they are self-funding with their own tax, and not part of the general budget”.

To quote myself: “Same as it ever was – Reagan supply side / trickle down / voodoo economics in the hallowed spirit of the Revelation of the Cocktail Napkin of Laffer™ – the perverse idea that leads one to conclude that as tax rates approach zero, tax revenues approach infinity.”

The Republicans cut taxes and then proceeded to spend like crazy, just like they have always done.

Duffy, can’t you do better than to quote, quite literally, almost word-for-word, the drivel of John Boehner and Mitch McConnell? Do you really want to associate yourself in public with people like that?

As I repeatedly point out, the majority of the federal debt is owed to *us*. It’s like we’ve borrowed money from our cookie jar to spend today. Okay, so we shouldn’t have done that, but geeze, it’s *our* cookie jar, so what’s the IMF and other idiots doin’ poking their noses into the situation?!

Regarding Mr. Duff’s nonsense, 95% of the difference in federal spending between 1950 and today is Medicare and Medicaid. The majority of Medicaid funding goes to the elderly poor. The elderly comprise under 13% of the U.S. population but consume over 50% of health care because the last 10 years of the average person’s life generally contains several major illnesses requiring major medical treatment. The majority of medical expenses are for treatment of major illnesses, primary care for minor illnesses is less than 10% of healthcare spending. Without Medicare and Medicaid to handle the heavy hauling for major medical for the elderly, any one of those major illnesses would kill a person. So, Mr. Duff, which old people do you want to kill first by cutting off funding for their health care? My mother? Mr. Dumka’s mother? Your own mother? Do you consider them “surplus population” and thus it’s okay to kill them? And, having killed them, since they’re simply “surplus population”, should we not recycle them as pet food? It would only make sense, after all — if they are useless surplus population, why should we keep the elderly around, right?

Unfortunately I suspect conservatives do not quite grasp how inhumane the notion of killing the elderly via depriving them of health care really is, because conservatives lacks both empathy and a working conscience. And then conservatives wonder why those of us who do have both empathy and a working conscience consider conservatives to be lizard people, lacking in two of the most fundamental characteristics of humanity…

– Badtux the Healthcare Penguin

Badtux, it is a mistake to credit Duffy with empathy OR a conscience. You can’t appeal to his conscience because he doesn’t have one. This aging Brit is nothing more than a talking-points-spewing right-wing nut-job, uninterested in real dialogue and certainly not motivated to advocate fair treatment for nonwealthy Americans. He has no stake… none whatsoever… in our relationship to our government, which is not his government; he just wants to spew his ideology all over us. It’s entertainment for him, nothing more.

Shorter Steve: do not feed the troll. Yes, I need to take my own advice.

Oh yes, I am quite aware of that, Steve. But I wanted to make it clear with actual, like, numbers, that conservatives are proposing the Soylent Green solution to the problem of the elderly consuming 9% of our national GDP for their healthcare. Just turned 65? Report to a pet food factory for processing, citizen! That’s the conservative solution — they believe that if you’re no longer employed/employable in the private sector, you’re now a “surplus asset” to be disposed of. They have no empathy, no compassion, no conscience, and become very upset typically when you even mention those words in their presence, claiming that they do possess those qualities. Well, I suppose they do… for some definition of the words “empathy”, “compassion”, and “conscience” in some alternate universe, where undoubtedly the unicorns are pink and cotton candy grows on trees… but not in this universe, of course, where they blithely propose the premature death of millions of elders by condemning spending on elders’ healthcare as “excess spending”. So it goes.

— Badtux the “Sometimes a response is for the NON-trolls” Penguin

There is also the fact that if you reach 65 you have been paying the “premiums” for that health insurance policy your entire working life, which is why you are “entitled” to it. It isn’t a “gift”, it is something you earn by working for a living.

The problems caused by the Republicants’ 2003 Medicare Modernization Act need to be cleaned up, but with 95¢ of every dollar spent by the program going to someone’s health care, I don’t see a program that is even close in its efficiency.

Okay, I just added up the numbers on my blog. WITHOUT the increases in Social Security since 1950, and WITHOUT Medicare/Medicaid, U.S. spending at all levels of government is virtually identical to 1950. In short, it’s worse than I stated above: not only are the Soylent Green Conservatives proposing to eliminate health care for seniors to reduce spending to 1950 levels, they’re also fundamentally proposing (with their “excess spending” rhetoric) to virtually eliminate *retirement pensions* for elders. I thought I was being hyperbolic with that “report to your local Soylent Green factory for processing at age 65, citizen” stuff about conservatives viewing elders as surplus property that needs to be liquidated. But turns out I wasn’t far wrong about what conservative spending proposals are *really* proposing…

– Badtux the Numbers Penguin

They want to shift the burden from income taxes to withholding taxes, and default on the Social Security Trust Fund. That has been the plan since they started talking about “privatizing Social Security”. If Wall Street can’t steal the money one way, they’ll try another. They always go for the pension funds.

The easiest way to reduce spending would be socialist medicine like the NHS. Socialist medicine is where the doctors are government employees and the hospitals are owned by the government. Think the VA hospital system extended nationwide. Every nation with a true socialist healthcare system has healthcare spending under 10% of GDP, as vs. over 18% of GDP like in the US, and has mortality rates that are similar to that of Americans of European descent. Whenever someone whines about the NHS I point out, “where are the dead bodies?” because the UK’s mortality rates from major illnesses are virtually identical to those of Americans of European descent (note that I’m talking about *mortality* rates, not the bogus “survival rates” often thrown about, because the UK doesn’t bother diagnosing things where having the diagnosis makes no difference in overall mortality rates and thus “survival rates” are not directly comparable).

But even at a combined 38% for pensions, Medicare, and general government spending, the U.S. is far from being at a level of unsustainability. The Scandinavians ran over 50% of GDP as government spending for decades and as far as I can tell nothing bad has happened to them other than long life, gorgeous modern cities, lots of mobile phones, and a surplus of beautiful women (hmm…..). Clearly, though, health care spending has to be reined in or it’ll keep consuming more and more of GDP, and since Medicare/Medicaid/other govt programs is 50% of healthcare spending, that goes directly to the bottom line… but Bryan already pointed out at least one way to do that, and the PelosiReidRomneyCare(*) bill has two other cost control items in it (comparative effectiveness studies to see what treatments really work and which are just a drag on the Medicare budget, and chopping the Medicare Advantage pork to be closer to the true cost of providing healthcare rather than a giveaway to private healthcare providers).

BTW, I notice that Mr. Duff hasn’t told us which granny he wants thrown under the bus in order to save on Medicare costs… he certainly hasn’t told us any *other* way he would save on Medicare costs other than throwing Granny under the bus. Funny how that works, eh?

– Badtux the Numbers Penguin

(*)I call it the PelosiReidRomneyCare bill because Obama had nothing to do with its fashioning and it more resembles Mitt Romney’s Massachusetts RomneyCare system than anything Obama proposed during his campaign.

Mr. Duff, the US has a sovereign fiat currency which means it can never run out of money and doesn’t need to borrow to pay its debts, which are denominated in that currency. The same is true of the UK in general terms.

Standard & Poors rated the junk bonds based on mortgage securities as investment grade and currently has less credibility than you do with anyone seriously involved with the real world.

The UK spends less than half as much as the US for health care per capita and gets the same or better results. Why should the US pay more than twice what you do – to give huge salaries to insurance executives?

You are entitled to your opinion, but you don’t get your own facts.

So in S&P and Duffer’s world, bundled liar loans are investment-grade securities, the U.S. could possibly not be able to pay off its dollar-denominated debts because the Federal Reserve has a limited number of 0’s and 1’s available to transfer into people’s bank accounts as freshly printed money, and unicorns are pink. At least, I think they’re pink, they would have to be, since elephants are pink in that universe.

Not in this universe, of course. But conservatives (and S&P) don’t live in this universe, they live in an imaginary one of their own making, where wishful thinking substitutes for facts and talking points substitute for thought. Because, y’know, facts have a liberal bias :twisted:.

– Badtux the Snarky Penguin

Wow, I just learned that GOVERNMENT BONDS ARE MADE OUT OF OIL in the DufferUniverse! Wow, thanks for that enlightenment! Of course, that has nothing to do with the issue of sovereign default in THIS universe, where government bonds are made out of 0’s and 1’s in a bank computer somewhere (or optionally printed onto paper), not oil, but what the hey, it’s always entertaining to get glimpses into that strange, bizarre fantasy universe that conservatives live in.

BTW, the world economy is $74T or so, of which roughly half is dollarized either explicitly or implicitly. Printing $2T/year to purchase *every* U.S. Treasury bond that expires in a year would result in a 5.4% global inflation rate in the Dollarzone — not desirable, but hardly Weimar-worthy. Of course, the notion that the Federal Reserve would have to purchase *every* U.S. Treasury bond that expires in a year in order to prevent sovereign default is laughable, they’d simply have to purchase sufficient bonds to make it clear they *could* do so and thus drive the interest rates back down to reasonable levels, but that just makes the Dufferverse even more unrealistic compared to the real universe that the rest of us live in…

– Badtux the Snarky Economics Penguin

Enough is enough, Mr. Duff.

If you want to know what is going on in the economy and why austerity is an incredibly stupid thing to do at this point, in this economy, in this universe, look at the meaning of: paradox of thrift, fallacy of composition, liquidity trap, zero lower bound, and aggregate demand.

When business is sitting on a couple of trillion dollars in cash and no one is borrowing with interest rates near zero, the economy won’t move. No one is going to invest or spend until they see an increase in demand. Until there are jobs, there will be no increase in demand.

Oil prices have soared, and demand for oil has tanked, because people won’t spend the money.

The only way to break the cycle is for a major increase in demand, and the only entity capable of generating that demand is national government of a country with a fiat currency.

I hope you like recessions, but the UK is about to have another one because of the austerians.

Pimco needs to make money, and you can’t make money on US Treasury bonds because the interest rate is so low, and is, in fact, negative on short term bonds. With people paying the US to sell them bonds, borrowing is not a problem for the US government, it is a problem for people trying to make money on bonds.

People are hoarding US Treasury bonds the same way they are hoarding gold, but you would understand that if you had bothered to look at the “paradox of thrift”, which explains that everyone is hoarding.

Another thing you don’t know is that you need some inflation to convince people to spend money. At the moment investors expect deflation, so they are spending. If they expect inflation, they will spend now to maximize the value of their money.

It is all basic stuff that was known decades ago, before politicians assumed they could reshape economics with ideology.

Bill Gross is moving out of Treasuries because he was betting on interest rates on Treasuries going up, and instead they stayed constant. Can’t make any money on that if you’re a Wall Street speculator who makes your living by gambling on interest rates rather than on providing any useful good or service. If you are, however, looking for a long-term investment that’s guaranteed to be paid back thanks to that marvelous invention the printing press, it’s hard to beat Treasuries.

BTW, here’s the interest rates those evil bond vigilantes are forcing upon the United States Treasury, as of the last Treasury auction:

Treasury securities

This week Month ago Year ago

One-Year Treasury Constant Maturity 0.24 0.23 0.44

91-day T-bill auction avg disc rate 0.060 0.095 0.145

182-day T-bill auction avg disc rate 0.110 0.150 0.220

Two-Year Treasury Constant Maturity 0.77 0.61 1.05

Five-Year Treasury Constant Maturity 2.22 1.95 2.57

Ten-Year Treasury Constant Maturity 3.51 3.29 3.85

One-Year CMT (Monthly) 0.26 0.29 0.40

One-Year MTA 0.295 0.307 0.421

Looks like ten-year Treasuries and five-year Treasuries are the best bet right now. But interest rates on *all* Treasuries are lower today than they were a year ago.

Yeah, those bond vigilantes are really rampin’ up, eh? 😈

– Badtux the Snarky Penguin

Actually, Badtux, I expect the Bond Vigilantes will show up at the next Treasury auction armed to the teeth and demand to be sold $10K bonds for $11K. It is getting absurd.

It would be nice to see an interest rate above 2% on a bank CD.

BTW, Mr. Duff, Moody and Poor knocked Japan’s rating down to nothing, and it had no effect on their ability to sell bonds. Argentina defaulted, and they can borrow whatever they think they want.

It is only the poor schlubs like Ireland and Greece who bought into the lure of the Euro, who have have problems selling bonds. They sold their souls to the European Central Bank and are paying the price.