The Jobs

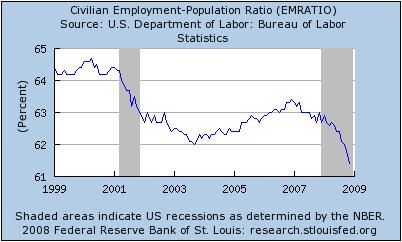

This is the most popular graphic today, the chart of employment from 1999 to 2009. This shows why we are in for long hard spell in the US economy – we don’t have any jobs in this country as we add 150K new people every month and people can’t afford to retire. The problem is simple:

No Jobs = No Wages

No Wages = No Purchasing

No Purchasing = No Jobs

This results is the event called “A Depression”.

I saw the chart first at Paul Krugman’s place. He simply noted the “terrible employment numbers”.

Fallenmonk said they were “off the cliff”, and cites the official u3 unemployment rate of 6.7% as not really showing how bad things are.

Sean-Paul invokes “the D word” and notes that the U6 unemployment rate is 12.5%. The U6 is the rate that the US government used until Reagan took over and felt that it was too negative and the U3, usually about half as large, was better for PR purposes to show that “supply-side economics” was working.

The Hedgemony’s tax cuts and actions to combat the recession of 2001 didn’t generate any jobs. You need an extra 150K new jobs every month to “tread water”. Any month with less than that many jobs is a loss to the market. Christmas of 2006 was the best quarter the Hedgemony had.

Jobs have to be created, that is the only way of ending this spiral.

Jobs = Wages = Purchases = Jobs

When wages remain flat, so do purchases and jobs. Finally raising the minimum wage will be of some help, but we need to start making things in this country, not simply selling things made elsewhere.

3 comments

Indeed, which is why monetarist “solutions” such as dumping a trillion dollars of freshly printed greenbacks into the market are just pushing on a string. It doesn’t matter that the banks have all this dough ready to lend out, if nobody has a job to pay back loans or is already overextended and can’t afford more loans. No loans = the money is just cluttering their vaults. Duh.

You need the money in the system to push on one end of the string. But all the pushing on a string ain’t gonna do diddly if you don’t have consumers pulling on the other end of the string. And if they don’t have jobs (or are fearing for the one they have), well, that’s friggin’ hard, huh?

– Badtux the Economics Penguin

Since I joined the ‘luckie duckies’ last week and have been engrossed in the situation from the inside I have discovered just how bad it really is. It is really ugly. There are not a lot of jobs to be had of any type. Though if you want to be a truck driver or work in a phone bank the odds look pretty good.

It is apparently beyond the understanding of the pundits who get the attention of the political class that jobs are the keystone to the economy. Watching the so-called recovery from 2001 and not seeing any job increase made the result obvious. You don’t need an MBA or a PhD in economics to figure out that when two-thirds of the GDP is dependent on consumption, you had better take care of the consumers, and the best way of doing that is to keep them employed.

Fallenmonk, I have a cousin who is a long-haul trucker, and he has to park his truck when the price of diesel gets too high or he can’t make his expenses. Trucking is generally flat fee, not cost plus, and when the fee doesn’t cover expenses you’re screwed.

IT is not a friendly environment for middle-aged people, especially if they want to get paid for what they know.